Giorgos Adalis: If the crisis was a letter would it be V, U, W or L? – Oil and the specter of war

24/06/2020

The big difference between a barrel of oil and a company share is that the former is a commodity and a strategic one at that, while the latter is an intangible asset. Oil, unlike stock, can be seen, touched, smelled and used as a base for 6,000 other products. It seems that last January the magnitude of the damage that the coronavirus would bring was not appreciated, because the ruthless war of oil prices that was taking place before the virus appeared was ignored.

The fact that the planet is experiencing the largest redistribution of energy fields in history has been underestimated and many analysts have removed from their studies the geopolitical importance of oil on the chessboard of geoeconomics. It was only when the virus spread from China to the West that some began to realize that we were not talking about a bad economic situation, but about a recessionary Armageddon.

Although the academic community has not yet classified the forms of recession, this year for the first time, the letters of the alphabet used for years to describe economists’ predictions about the course of the recession and expected growth were discussed in Greece.

Theorists of prediction V

The majority of economists in Greece had been slow to admit that there will be an impact on the international economy. And then they said it would be V-type, meaning that the recovery would be just as fast as the fall. This view was even projected on the course of the Greek economy. That is, there will be a small drop in GDP within the first quarter of 2020, which will be temporary and within the second quarter there will be a rapid recovery, which will bring minimal blows to GDP.

After the first weeks of lockdown in the West, fans of the V-type theory realized that things were much worse. Seeing that the virus was sweeping the backbone of large economies, they found that what happened in China is just ahead of what will happen in the West. And they belatedly started, discovering that 30 million barrels of oil were missing from global demand.

They realized that they were wrong and so a revision of many such estimates was made. They argued that the recovery would not be V-type, but U-type. That is, it would not come immediately, but the recession would last longer and after some time this year, we would return to last year’s levels with greater difficulty.

Geopolitics and W type forecasting

Shortly afterwards, while oil demand was literally shattered, the money markets made a partial recovery (lasting 10 days) and with it the theories of a direct exit from the crisis. No one expected, however, that Saudi Arabia would flood the markets with crude oil, dropping prices to the floor.

Thus, a portion of economists have argued that the correct forecast would be in the form of the letter W. That is, in the period January-July we would have the full evolution of the economic phenomenon of transitions (W) and after two such transitions, the market would return to normal.

The correct theory: L

However, we believe that none of the recovery theories V, U and W are correct. No matter what some economists say will happen in the meantime, they conclude that after the fall, the economy will return to normal. However, this is unlikely to happen soon. Given the collapse of the energy market, an automatic return to the previous state is impossible, by just lifting the quarantine, as these theories claim.

We believe that the most correct view of the economic phenomenon is expressed by the letter L, which more accurately depicts the duration of the recession. Many international analysts are involved in this, dealing with the energy market. Proponents of the L theory were initially few, but from the outset they rightly predicted that we would have a recession within 2020 that would last more than 12 months.

It was against the prevailing view that GDP indices would close with a slight positive sign in 2020. Unfortunately, L fans were not taken seriously, until after April 20, when we witnessed the unprecedented economic downturn in oil prices.

Low oil prices

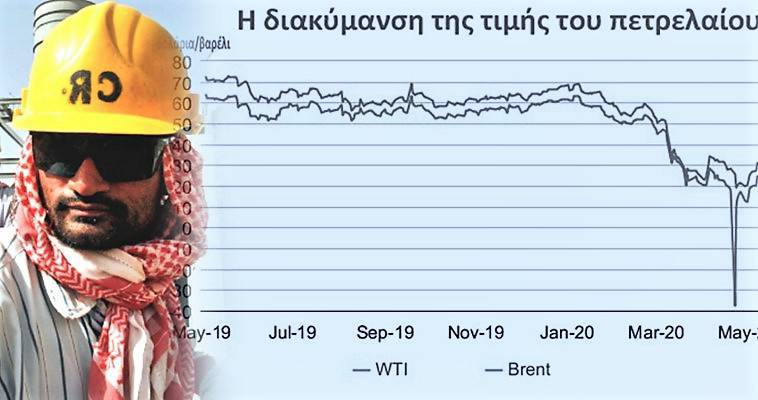

If one analyzes the financial markets and oil prices superficially, one will get the impression that the proponents of the W theory are justified, as this is somewhat the case today. Unfortunately, this is not the case. In the period May-October 2018 e.g. WTI oil fluctuated around $ 70 / barrel, while in May-December 2019 it fluctuated around $ 60.

On January 7, 2020, it began its decline reaching a negative close of -37 dollars on April 20. It should be noted that on that day the WTI fell in a single session, from 15 dollars even to -40 dollars to finally close at – $ 37 Today, while it is gradually recovering after the restrictions are lifted, it is still well below the 2018 and 2019 levels. It is between $ 36 and $ 40.

We could say that we have V, U, or W if prices and indicators in the energy market had already reached the levels of December 2019, ie at $ 60. But this is not going to happen soon since the structure of the whole industry has suffered huge losses. But what keeps oil prices low? Many factors. Stating some of the most important:

- The oil price war has not stopped for a second

- The world’s oil storage tanks are full, and even the negative price scenario has not faded.

- Ships (tankers) that are free to rent are at a minimum with the result that their rental prices have quadrupled.

- The booming demand for oil is a thing of the past. The negative psychology of consumers is overwhelmingly affecting tourism and public transportation even after the quarantine is lifted.

- Energy giants must enter a period of balance sheet restructuring.

The decline in jet fuel consumption that keeps air fleets grounded even after quarantine is lifted has resulted in an endless cycle in which rising unemployment is hurting tourism, therefore car rentals, and therefore the car industry, and therefore the primary sector and minerals!

The good and bad scenario

We have analyzed in detail in our previous articles how much oil demand will decrease this year.

Clearly, then, the removal of the lockdown will not automatically mean a return to normalcy. The first official confirmation of those who supported the L-type forecast came recently from the International Energy Agency. The report predicts that for the whole of 2021 there will be a drop in the rate of 2.4 million barrels per day compared to the consumption of 2019. Most of the loss will be due to the tragic situation of air transport and the decrease in demand in jet fuel.

All of this, of course, is the “good scenario” that the planet will not need to enter a quarantine for a second time after a second wave of the virus. If the oil price war ends this year and no new quarantine is imposed at the same time, the huge damage to the energy market levels will rise to those of 2019, after 2022. Therefore, the L-type forecast is the most correct because the economic crash lasted three weeks. while full recovery will occur at a depth of two years according to the good scenario and 4-5 years according to the bad.

However, in the next 18 months we will see a lot more important development of the two rival “factions” that will be hit hard. On the one hand, those who support the completion of this oil cycle through a virtuous L-type economic recovery that will last 18-24 months. On the other hand, the well-known market hawks, will be looking for an oil price rally at this time, not through the stock markets, but through warplanes. We will speak of who these “factions” are in our next article.