Ioannis Mpasias: The future of the energy environment, the eastern Mediterranean, and Greece

03/09/2020

The dynamics of the international energy environment on a scale of decades are now based on natural gas and will continue to be supported by current alternative energy sources for decades. From this point of view, the sea, the main geographical area of the underwater gas fields, and energy become intertwined. A quick look at this relationship between the seas and energy allows us to also see the position of Greece from the same perspective.

As for coal and lignite, for which fines are imposed, so for any means of implementing alternative energy sources, such as renewables, a tax on environmental pollution, future, and present, must also be imposed. Let us not forget that for carbon dioxide the fine again rose to 30 euros per tonne, although in March 2020, due to the pandemic and a drop in consumption, it had dropped to 16 euros.

Something parallel is happening with onshore oil installations and offshore hydrocarbon extraction platforms that are aging, are worn, or out of production due to old technology. The dismantling cost per tonne, for metal alone, is between 2,000 and 3,000 euros and a small platform incorporates a few hundred tons of metal. Every company, state-owned, or private, has to set aside in a special account each year an amount to uninstall them. This has been the case in the oil industry for decades and has been applied in the past to the Prinos field in Greece.

Respectively, for batteries (not only of the cars), as well as for the materials for wind turbines and photovoltaic cells, but some monetary protection should also be imposed for pollution that will be created when they are decommissioned, 20 years later. The price must be set through an evaluation and cost assessment from today, in the context of the principle of sustainable development.

Rare earths and the seabed

This problem of contamination is not a topical issue, as we are currently in the race to control the rare earths, manganese, copper, and cobalt and, in general, minerals and metals needed to produce energy from renewable resources.

A look at the dominance struggle today for cobalt control for batteries (especially cars) is helpful. Cobalt is combined with lithium and its price since 2017 has increased by about 70%. The market is currently dominated by the Democratic Republic of the Congo (formerly Zaire), but experts say demand will increase 15-fold by 2030 and more than 10 countries will be involved in the battle for control with China leading the pack.

At present this struggle is focused on terrestrial environments but in the future it will be extended to marine environments, due to the renewed interest in polymetallic nodules located on the ocean floor and especially in the Atlantic and Pacific in international waters, ie outside delineated EEZs limits.

Great depths technology

These issues are managed by the International Seabed Authority (ISA) under the auspices of the UN. This Authority announces international tenders, evaluates, supervises and manages the work of companies, consortia, or government agencies that explore, not only for metals, in international zones, ie in zones that are not within the EEZs of states. One of the basic conditions is the preservation of the marine environment, but it goes beyond this.

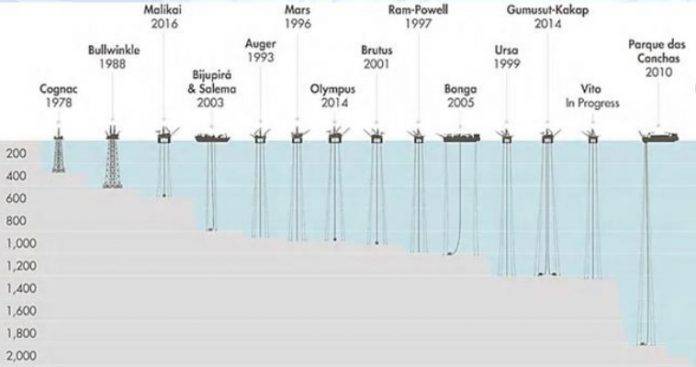

Countries such as the USA, France, Germany, South Korea, Brazil, etc. have been active for years for the processing of nodules at sea depths exceeding 3000 and 4000 meters. We are again in the areas of deep technology, mechanical and electrical installations on the seabed, and environmental protection.

These issues have also been discussed concerning Greek waters, although exploration work has not progressed as quickly as it should. There are no nodules in Greek waters, nor even in the Eastern Mediterranean, because we have a convergence of tectonic plates and not the formation of oceans as in the Pacific, Atlantic, and Indian Oceans. At the international level, it is becoming more and more understood that all future energy games will be played at sea and this is true as everyone sees today for our region.

The Greek dimension

In the Eastern Mediterranean, there has been extensive research into the possible existence of hydrates in the 1980s. The then IGME (now known as Hellenic Survey of Geology and Mineral Exploitation) participated not only actively but also creatively in the studies and sampling in the southeastern Aegean, while in the early 2000s large-scale research was carried out on the mud volcanoes in the Eastern Mediterranean, especially by French missions. The energy map of the area is now largely shaped.

Mud volcanoes and hydrates are associated with the seabed. The former due to the release of methane on the seabed surface and the latter due to the retention of methane in ice in the surface layers of the seabed. Large mud volcanoes are located especially south of Crete and hydrates east of Crete. At present they are not areas of industrial exploration that could lead to exploitation activities in the next decade.

On the other hand, both environments of methane, ie natural gas, count on the table of the negotiated value of the Greek subsoil for a horizon of 20-30 years. This should not be neglected. EDEY (Hellenic Hydrocarbon Management Company), as a competent authority, must continue to monitor developments.

An understanding of the dynamics of the international energy environment on a decades-long scale is required. Listening to the International Energy Agency, gas will continue to bridge today’s alternative energy sources for decades, unless major technological advances allow for energy production through non-energy-intensive processes unrelated to today’s alternative sources.

The EEZ west and southwest of Crete

For Greek reality, the geophysical surveys west and southwest of Crete are part of this bridge program that offers natural gas. In fact, they will constitute a milestone if they start at the end of 2020, as planned. At the beginning of June 2020, the Technical Committee for the offshore plots west and southwest of Crete, composed of representatives of the companies and EDEY, approved the technical program for the geophysical works, as well as the schedule of necessary permits from the Ministry of Environment and Energy.

If the research proceeds quickly, Greece will be able to enter the second phase of the surveys in 2022 without delay. This second phase will be the harbinger of the first drilling in each of the two offshore plots of Crete. The internationalization of the region is not only related to the Greek EEZ. It is also related to the Libyan EEZ (south of the middle line), because the submarine geological structures of the two EEZs are similar, and further east, as far as Egypt.

These are not secrets, nor are they geopolitical gossip. Available geophysical data from previous decades are sold by international geophysical companies. Anyone can be officially informed on the Internet and any company can ask to see them and buy them. EDEY started, in 2019, an effort to collect what is available through foreign companies and what should be submitted to the competent Greek authority. A sufficient amount of data has already been collected. This work must not be left unattended.

The energy map of the Eastern Mediterranean

EDEY published a map that exists in many of its studies and presentations. This illustrates the existing and under construction distribution of refineries, liquefaction plants, gas stations, and pipelines in the south-eastern Mediterranean. It is characteristic that by the end of 2020, Turkey will have three refineries and three FSRU (Floating Storage Regasification Unit), Syria one refinery, Lebanon one FSRU, Israel two refineries, one LNG stations (gas liquefaction station) and one FSRU, Egypt three LNGs and three refineries, Greece three refineries and two FSRUs, and Cyprus one FSRU. Needless to say, there is over-concentration.

But for FSRU stations to work, liquefied natural gas needs to arrive by boat from nearby or remote areas outside the Mediterranean, where there are LNG stations. About $ 450 billion has been committed since 2019 internationally for the construction of liquefaction plants. It is estimated by experts that the total investment for the coming years would be close to one trillion dollars if declining consumption and the recession does not affect construction plans.

The problem becomes more complex if we take into account that several national pension funds around the world and large funds that also manage pension funds have invested part of their portfolio in such development programs that are currently affected by the recession and the pandemic. It will be difficult to decide where the scales will tilt in the Eastern Mediterranean in two years, ie towards LNG stations or pipelines.

However, what is certain is that gas discoveries in the Greek EEZ would allow the rate of replacement of imports by domestic production to be assessed. They would further encourage the international investment sector towards one, the other, or a combination of the two solutions. Gas production will undoubtedly require infrastructure, the cost of which can be shared with the cost of investment in transportation.