Giorgos Iliopoulos: The Turkish economy is hurting while Erdogan is acting like a raging bull

08/11/2020

Since the 2018 crisis, which has literally plunged the Turkish lira, dramatically increasing Ankara’s borrowing costs, the Turkish economy has been recovering with data that seem to suggest it has bypassed the problem. However, this change is based on low-cost appropriations that favor the expansion of consumption and the construction industry.

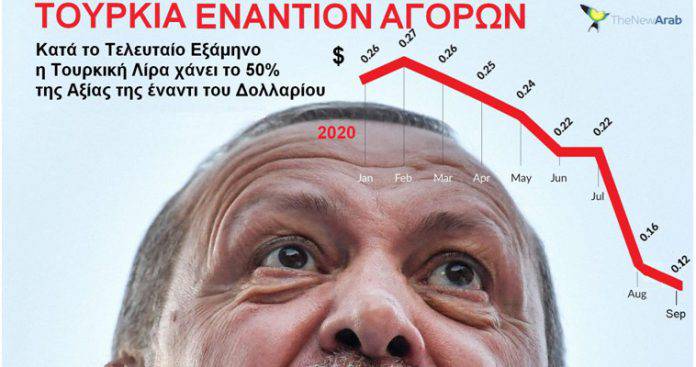

Unfortunately, the solution, which in many ways resembles the performance of an athlete under the influence of anabolic steroids, makes the currency drastically more vulnerable, with the result that from the beginning of 2020 there is a rapid devaluation against the US dollar resulting in a return to 2018 levels, in March.

On October 26, 2020, the Turkish lira against the US dollar broke the 8: 1 barrier for the first time in its recent history, with the country’s central bank spending according to Goldman Sachs in the last eighteen months (by 31 August) more than 134 billion in a desperate effort to support the domestic currency.

The continuous rise of foreign exchange risk, and in fact to extremely dangerous levels, coincides with a period when, while official inflation is given at 11.75%, real inflation, according to Johns Hopkins University, is moving towards the levels of 40% from the beginning of 2019, a fact that places the country in the top 10 in the world trying to survive in an environment of hyperinflation. In addition, the 8: 1 exchange rate against the dollar has a symbolic significance for Turkish public opinion, the business community, and economists, mainly due to its purely psychological effects. This week it slid to 8.5400 versus the dollar and just above 10 versus the euro last Tuesday.

In a fully dollarized economy, the pressure exerted mainly on banks and companies that have dollar-denominated loans is evolving with suffocating intensity, while the problem of the country’s supply of raw materials and the smooth operation of the energy sector is also emerging. As Moody’s has been warning since September, the main reason is focused on the depletion of foreign exchange reserves. The rating agency also points out in the evaluation report the threat of a severe crisis in the balance of payments.

Control of state mechanisms

At the same time, President Erdoğan’s tensions with both the EU and the US are escalating into wider concerns about his ability to manage his country’s problems. The fact that in the last period he exercises through the referendum, and not just, unprecedented control over the state mechanisms and the nominally independent central bank of the country, adds great doubts for the survival of its financial sector.

In fact, its management has disappointed foreign investors when, after mid-October, it avoided raising its interest rates by 1.75% for the second time, in order for its interest rate to exceed official inflation. But all analysts believe that the move is necessary mainly for psychological reasons, in order to prove that it is really turning to support the Turkish currency, instead of being indifferent to its fate. On the contrary, they estimate that the increase in the interest rate on emergency short-term lending to domestic banks to 14.75% is an invisible move to reduce liquidity, without provoking the wrath of President Erdogan. Now Erdogan has fired the Central Banker Murat Uysal, who wanted to take the necessary rate hike measures.

The move, however, is exacerbating the climate in the markets, which realize that the president’s suffocating shadow is taking away the last fidelity of confidence in his central bank. In fact, according to the analysts of the German Commerzbank, the Erdogan regime has lost the last nuggets of credibility, as a result of which any measures to control the impending losses are of much more interest than any attempt to convince the markets of a possible turn to one. monetary policy focused on stabilization.

The external fronts

With the entry into 2020, Turkey escalated its provocations and interventions in Libya, Syria, the Eastern Mediterranean and most recently in the Caucasus, where it is exploiting the chronic Armenian and Azeri frictions over the Nagorno-Karabakh region in order to provoke a local conflict, which, however, risks evolving uncontrollably.

In addition, it openly provokes Egypt, Israel, the Gulf Emirates, and Saudi Arabia, while aggressively pushing EU and NATO countries, such as France, Greece, and Cyprus. It poses equally significant problems in NATO and the US, with the purchase of Russian weapons systems and especially with the S-400 missile defense system, risking retaliatory sanctions and putting great pressure on the Turkish lira and the domestic financial system.

The sharp new tensions with France, combined with the most provocative statements by top Turkish officials and their counterparts in Western countries, are forcing President Macron to recall the French ambassador to Ankara, following his scathing remarks on Islam. For their part, officials and cronies of the Erdogan regime also launched verbal attacks against Europe, claiming that it treats Muslims as it did during the period of Jewish demonization during the 1920s.

Unbelievable Turkish statements force European Council President Charles Michel to openly accuse Turkey of continuing provocations and unilateral aggression in the Eastern Mediterranean, to which are added unacceptable insults. For his part, President Erdoğan dares to threaten the United States about sanctions planned over Turkey’s involvement in the Caucasus region and the raging clashes in Nagorno-Karabakh.

Ankara continues to support and equip the Azeris with modern systems, with Washington reiterating for the umpteenth time the threat of sanctions on the occasion and the purchase of the Russian S-400 anti-aircraft gun system. However, the Turkish president insists on his position and declares to the Americans that they have no idea who they are dealing with.

The Turkish economy is in decline

Despite the recent split of the 10: 1 exchange rate in the European single currency, which is now mainly psychological pressure, the competent Turkish authorities are not intervening with substantial countermeasures, such as capital controls or interest rate increases of at least 175 points, to move above inflation (11.90%).

The wrong obsession and the consequent strict government mandate for low-interest rates led to squandering foreign exchange reserves of 100 billion dollars in the futile attempt to support the lira in the ten-month period January-October 2020, resulting in the devaluation of the 30% dollar since the beginning of 2020.

The Erdogan regime is systematically destroying a key reputation of financial discipline, which the country had gained through hard and painful sacrifices, and showing particularly positive growth rates. At the same time, valuable resources have been exhausted to a huge and greedy unemployment fund and various grants to curb the reactions of the population but destroying stocks necessary for the defense against the current catastrophic crisis.

In addition, dividends are transferred in hard currency to Turkish organizations and companies with subsidiaries abroad, to the Ministry of Finance, which will obviously be spent either to support the currency or to buy raw materials. Given the new downturns in the Turkish economy, to the level of garbage, the accumulation of financial problems will inevitably worsen, non-performing loans will continue to grow exponentially and formerly healthy state-owned Turkish companies will be forced to go bankrupt.

The big problem is that while the Erdogan regime is wrongly convinced that it is ensuring economic growth and is therefore going to reap great success, the negative effects on the real economy and the fundamental size of the country are leading to collapse. The consequences for society that will intensify in 2021, may eventually turn out to be unmanageable, with the consequence of the forced recourse to the IMF with effects that at the moment it is not possible to determine clearly.

Already crossing the 10: 1 exchange rate against the European single currency, President Erdogan considers it appropriate to sign a presidential decree firing central bank governor Murat Uysal, after 16 months in office, to replace him with the former Minister of Finance (2015-2018) Naci Agbal. Obviously, the worst is coming…